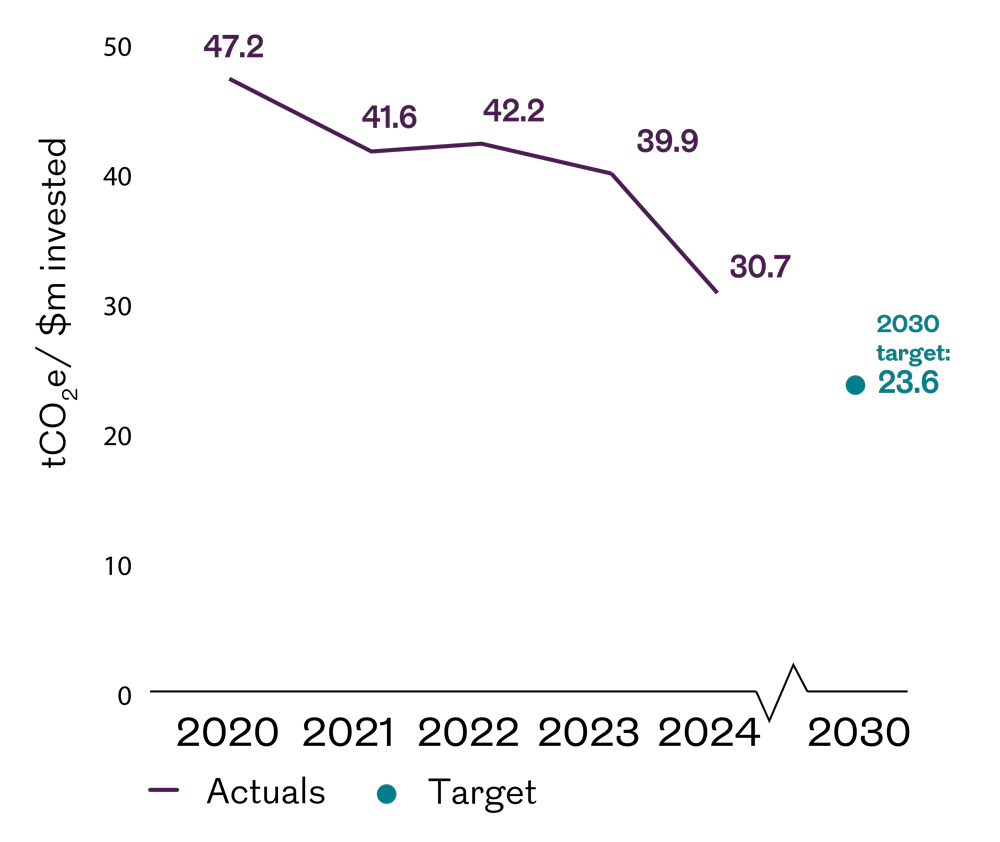

Reduce emissions of our investments [1] by 50% by 2030…

2025 is proving pivotal in the race to net zero. As an asset manager, we’re tracking our own progress and supporting others through active engagement.

- Through our Net Zero Stewardship Programme we engaged with 19 high-emitting companies and held 84 climate-related engagements to support credible transition plans.

- Engagements with utilities and financials showed progress on transition plans, but also revealed gaps in resilience, emissions, and strategy.

- Proxy voting on climate: we voted against directors at 49 companies and supported climate resolutions to hold boards accountable and push for stronger climate governance.

The first half of 2025 has lived up to expectations – critical in this defining decade for climate action. As an asset manager, we track and monitor our own progress against our climate commitments.

…by engaging with issuers representing 70% of our financed emissions…

…to achieve net zero [1] by 2050

As of 31 December 2024, we achieved a 35% reduction in carbon footprint against 2020 baseline. This reflects our firm-wide progress towards net zero. For product specific objectives you should read the relevant product or fund prospectus as each have different investment objectives.

Figure 1: Royal London Asset Management carbon footprint and mid-term reduction target

Source: Royal London Asset Management, as at 31 December 2024

Net Zero Stewardship Programme

Our Net Zero Stewardship Programme (NZSP) is a key lever with which we seek to achieve our climate commitments and create real world change. As part of this programme, we engage and collaborate with the companies that contribute most to our financed emissions. In the six months to the end of June 2025 we engaged with 19 companies on 30 occasions as part of our programme. The aim is to assist the companies in their transition to a sustainable future. Beyond the programme we’ve engaged 52 companies and held 84 climate-related engagements in total.

Emissions reduction progress of many countries and companies has not been at the rate required to achieve the goals of the Paris Agreement. Yet, we continue to see that many of the companies we engage with are making improvements to their plans, and we seek to report transparently on this progress. In our 2024 Stewardship and Responsible Investing Report, we provided an in-depth analysis of the oil and gas, diversified mining, and industrials sectors. We also published a supplementary document summarising our proprietary Climate Transition Assessments (CTA) for the 40 companies included in 2024.

To complement the 2024 reports, this update highlights our interactions and observations in other sectors, namely utilities and financials. We also share examples of equity votes during proxy season, demonstrating how enhanced research integration and engagement activity has informed our voting decisions.

Voting and engagements with companies takes place with numerous investors, it is as an industry that we collectively can drive progress to meaningful change within companies.

Utilities

Centrica is a British utility and parent company of British Gas that has been part of our engagement programme for over four years. In November 2024, we met with the company to discuss and provide feedback on its updated climate transition plan. Earlier this year, Centrica published its updated plan, which included several notable improvements.

Centrica engagement and voting timeline

| 2021 |

| We began our engagement on net zero providing feedback on their draft climate transition plan. |

| 2022 |

| We wrote them a letter outlining our engagement priorities, ahead of meeting them to discuss. We noted the company’s climate transition plan and its climate commitments, but we abstain on the relevant AGM vote as we wanted more stretching targets and a clearer decarbonisation plan. |

| 2023 |

| We met with the company to encourage action on our communicated engagement priorities. We also discussed just transition and actions the company can take to consider the social side of climate transition. |

| 2024 |

| We met with the company and provided feedback on their updated climate transition plan. |

| So far in 2025 |

| The company published its updated climate transition plan. We again chose to abstain on the relevant AGM vote, acknowledging the positive progress made by the company alongside a few remaining necessary improvements. |

Why abstain at AGM votes?

We use this option when resolutions fall short of best practice but are not material, to signal initial concerns, or when issues are material but not fundamental and we have yet to raise them with the company. Although a vote for or against a proposal sends a more direct message to a board, we appreciate that not all issues are clear-cut. We use an abstain to signal our initial concerns and invite a dialogue.

Positives

The company now aims to be operationally net zero by 2040 and is committed to addressing the largest portion of its emission by supporting its ten million customers to achieve net zero by 2050. Centrica’s latest plan’s increased detail and transparency indicate a more credible approach to meeting its ambitious targets.

Notably, it has enhanced its strategy to reduce emissions from gas sales. It aims to double its share of the heat pump installation market by offering more attractive customer propositions and advocating for supportive policy conditions. Progress is being tracked against a target of selling 20,000 heat pumps annually by 2030[2].

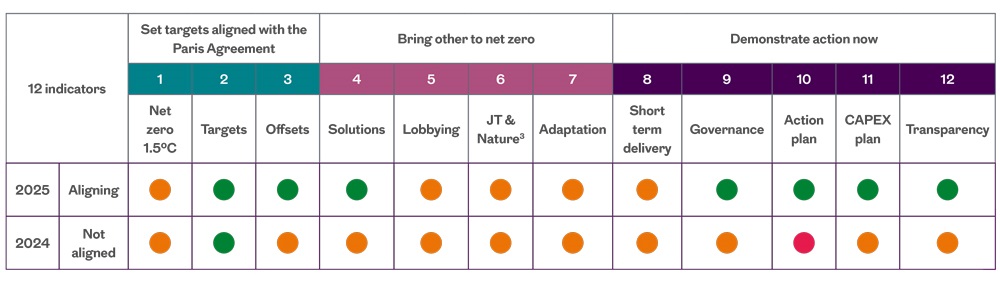

We also encouraged Centrica to provide a clear investment plan to support its strategy. We were pleased to see improved clarity on the company’s investments and the safeguards in place to ensure alignment with its net zero goals. As a result, our Climate Transition Assessment (CTA) of Centrica improved from ‘not aligned’ in 2024 to ‘aligning towards a net zero pathway’ in 2025.

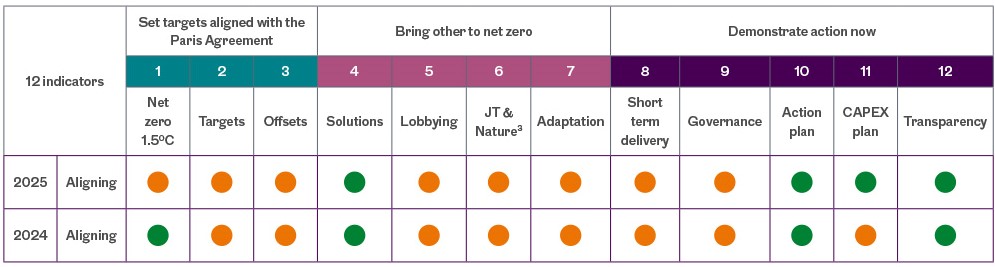

Figure 2. Centrica, Climate Transition Assessments

Red: Does not meet the minimum standards I Amber: On track I Green: Meets the highest standards.

* Indicator 6 - JT & Nature is Just Transition and Nature

Areas for improvement

There is however still room for development. We are concerned with the annual growth in emissions on an absolute and intensity basis, and we encourage Centrica to outline how it will adapt to physical climate risks, enhance resilience and incorporate biodiversity considerations into its strategy. Demonstrating progress in these areas will be key to strengthening its long-term sustainability and help build investor confidence.

We are scheduled to meet with Centrica again later this year to continue our engagement and address these areas.

Financials

NatWest Group is a large UK banking group, with subsidiaries including its namesake, Royal Bank of Scotland and Coutts. We have engaged with the bank on climate since 2021. In Q2 this year we met with NatWest’s Climate team to discuss the bank’s latest climate disclosures and transition strategy. The engagement focused on how the bank is implementing its sustainability ambitions and responding to policy and sector-specific challenges. It aims to achieve net zero across its financed emissions, assets under management, and operational value chain by 2050. The meeting clarified NatWest’s current strategy and highlighted both progress and ongoing challenges.

Positives

The bank reaffirmed its commitment to aligning sustainability with customer needs and embedding it into day-to-day decision-making. We were encouraged to learn that NatWest is using updated carbon budgets from the UK’s Climate Change Committee to review its climate ambition and sectoral financed emissions targets in 2025. The bank noted that investor feedback from these engagements would inform future strategic updates.

Residential mortgages are one of the largest sources of the bank’s financed emissions. While NatWest has taken steps to support residential decarbonisation, such as green mortgages, Energy Performance Certificate (EPC) targets, and resourcing sharing through its Home Energy Hub, it acknowledged barriers like skills shortages and low retrofit uptake.

We also had a constructive discussion about NatWest’s approach to oil and gas clients via its risk acceptance criteria. The bank welcomed our insights on the sector’s transition progress as it plans to review its assessment of the oil and gas sector. In July, the bank published its new Climate and Transition Finance Framework and announced a £200bn funding target by 2030. In our most recent assessment, NatWest continues to be ‘aligning towards a net zero pathway’ [3].

Figure 3. NatWest Climate Transition Assessments

Red: Does not meet the minimum standards I Amber: On track I Green: Meets the highest standards.

* Indicator 6 - JT & Nature is Just Transition and Nature

Areas for improvement

The bank is undertaking a review of its climate targets and policies and we believe it is important for the bank to be resolute in its support for ambitious climate action in the real economy. We hope to see sectoral financed emissions targets remain ambitious, and a lending policy to oil and gas clients which mandates up to date transition plans. We also continue to engage with the bank on just transition, and how it meets our investor expectations for the banking sector. Given NatWest’s presence as one of the largest banks in the UK, we believe it has a vital role in achieving the nation’s net zero targets.

Climate votes

Proxy season has also kept us busy in 2025. With net zero moving from being just a headline, to strategic necessity, and with the 2050 deadline moving ever closer, we further integrated our climate research into equity voting decisions, particularly for companies in our NZSP. We have provided some voting figures and some case studies below. You can also find out more in our 2025 proxy voting season review.

Figure 4. Votes from January to June 2025

| Voted against directors on climate grounds at: | Supported shareholder resolutions on climate at: | Supported ‘Say on climate’ votes at: |

| 8 companies part of NZSP 49 companies in total |

2 companies part of NZSP 9 companies in total |

1 company part of NZSP 8 companies in total |

In Q1 2025, BP, a British multinational energy company, announced a ‘fundamental reset’ of its strategy, shifting focus away from low-carbon energy growth and towards increased oil and gas exploration and production instead. The result is a decreased ambition for its emissions reduction targets. The company is seeking to shift to a strategy which it believes is pragmatic about transitioning and aligns closely with demand for its oil and gas products [4]. We understand the need to reflect the broader economy’s energy transition. However, we are concerned that this shift could expose shareholders to unnecessary risk amid volatility and undermine its emissions goals and transition pathway.

Figure 5. Shareholder resolutions – BP Chair of the board re-election

We have engaged extensively with BP; we met with the Chair in late 2024 and the Company Secretary in early 2025. We urged the company to consult shareholders on any climate strategy changes it intends to make and reiterated our desire for enhanced disclosure on how investment discipline in oil and gas is being maintained. In Q1 of this year we also co-signed a letter with 47 other investors to BP’s Chair, further reiterating these two asks.

We were disappointed that the AGM included no such proposal and therefore our concerns were not addressed. As such, guided by our Climate Transition Assessment showing BP’s misalignment with climate goals and our governance concerns, we escalated and voted against the re-election of the Chair. BP has announced plans to appoint a new Chair, and we look forward to working with them once in place.

Figure 6. Shareholder resolutions - Suncor Energy Chair of the Health, Safety and Environment and Reserves Committee re-election

We have engaged annually with the Canadian oil company Suncor since it entered our programme in 2023. While the company remains committed to emission reduction and supporting Canada’s national climate ambitions, our Climate Transition Assessment raised concerns about the adequacy of its decarbonisation strategy and climate risk assessments. The removal of public sustainability disclosures, due to uncertainty surrounding Canadian anti-greenwashing regulation, further complicates matters.

Reflecting our concerns, we voted against re-election of the incumbent Chair of the Health, Safety and Environment and Reserves Committee. We plan to continue engaging with the company to develop a robust climate transition plan including science-based emissions reduction targets and a clear decarbonisation strategy that supports a just transition.

Figure 7. Shareholder resolutions - Shell 2025 AGM shareholder resolution

At Shell’s AGM, we supported a shareholder resolution calling for improved disclosures on Shell’s liquified natural gas (LNG) growth strategy. We have discussed the topic of LNG extensively with Shell, but given the complexity of the topic, we felt that extra information would enhance our financial and climate analysis of the company. Although the company did provide some additional disclosure during engagements prior to the AGM and through public disclosures, we continue to see value in supporting the resolution.

We engaged with the company post AGM and shared our concerns around the need for clearer disclosure, demonstrations of alignment with Shell’s climate commitments, and the goals of the Paris Agreement. The company was receptive to our feedback and committed to updating us on its next steps.

Looking ahead

In the second half of 2025, we will be continuing our climate engagement efforts, focusing on material issues for different companies and their respective sectors, strengthening our voting position and expanding our research and engagement into the intersection of climate, social and nature. You can read more on these topics here.

All information sourced Royal London Asset Management, as of 30 June 2025, unless otherwise stated.

- The term Net Zero means achieving a balance between the amount of greenhouse gases emitted into the atmosphere and the amount removed from it. The commitment is based on the expectation that governments and policy makers will deliver on commitments to achieve the 1.5°C temperature goal of the Paris Agreement. It also assumes this action does not contravene Royal London Asset Management’s fiduciary duty to external investors. The commitment is baselined on the year 2020. It includes assets managed and controlled by Royal London Asset Management, but excludes segregated mandates managed on behalf of external clients, unless otherwise instructed.

- Centrica Climate Transition Plan, Emissions and Targets

- Our approach to climate change | NatWest Group

- BP Results 1Q 2025

Important information

Our voting, engagement, research, and advocacy activities are designed to be pragmatic, informed by evolving market insights and local best practices, and always aligned with the long-term interests of our clients. These activities aim to enhance the value and integrity of our investment decisions.

Please note that voting and engagement practices may not apply uniformly across all Royal London Asset Management funds or strategies, as each has distinct investment objectives. For details specific to your investment, please refer to the relevant fund prospectus.

For professional investors only. This material is not suitable for a retail audience. Capital at risk. This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. The views expressed are those of the Royal London Asset Management at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.