Read the latest views from Trevor Greetham, Head of Multi Asset at Royal London Asset Management, in the latest Investment Clock: Strategy Update.

“The Investment Clock has been in Stagflation for the last nine months, a stage of the cycle that is bad for both stocks and bonds, but good for commodities. Recent commodity price weakness suggests we’re swinging around to the next stage of the cycle: bond-friendly Reflation.

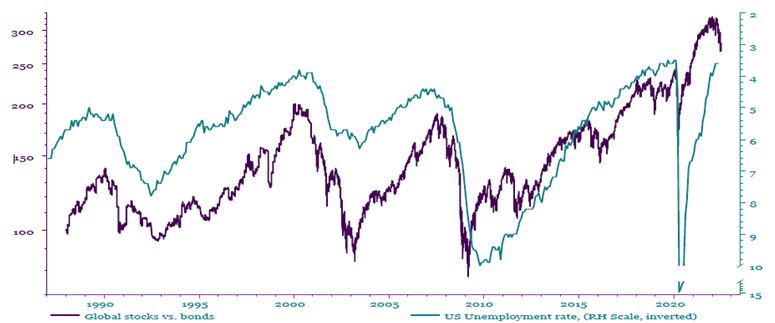

“Stocks could see a second phase of bear market driven by earnings weakness. A trough is likely to come only when unemployment rates are close to peaking, which could be a year or so from now. Broad diversification, active tactical asset allocation and disciplined downside risk management will be key to navigate the bumpy road ahead.”

Back to the 70s:

In the deflationary four decades to 2020, central banks were willing to cut rates at the first sign of a slowdown and, as a result, business cycles were long. The onset of the pandemic marked a regime shift to a high inflation world with reactive policy and short cycles. Pandemic fiscal stimulus was left in the system and central banks printed money long after lockdowns ended. A surge in consumer demand hit a supply-constrained world economy, pushing inflation to multi decade highs. Russia’s invasion of Ukraine made matters worse. Central banks are woefully behind the curve and need to create spare capacity to bring inflation back towards target levels. Recessions in major economies are almost certain. Investors should respond to this new 1970s-style era of macro uncertainty with broad diversification, active tactical asset allocation and an explicit approach to managing downside risk.

Broad diversification to provide resilience to inflation:

While it should drop in a recession, we expect to see recurring bouts of inflation over the medium term due to a chronic under-investment in commodity capacity as we transition to net zero, massive public spending programmes, de-globalisation (including Brexit) and geopolitical risk. We improve resilience to inflation in our Governed Range and GMAP funds by including the likes of commodities and commercial property alongside stocks and bonds. We also opt for more of a value tilt within equities than standard global indices would give you, reducing our reliance on a few expensive growth sectors.

Active tactical asset allocation as the cycle evolves:

The return of short business cycles makes tactical asset allocation critical. We have been overweight in commodities in our multi asset funds since 2020 Q4. We could find ourselves overweight in government bonds when inflation starts to fall. Stocks could see a second phase of bear market driven by earnings weakness. A trough is likely to come only when unemployment rates are close to peaking. With sentiment depressed we are currently close to neutral, but our exposure is tilted towards defensive sectors and less expensive markets like the UK which are weathering the bear market better.

Managing downside risk in a bear market:

For investors looking for a more explicit approach to managing downside risk, the Multi Asset Strategies Fund (‘MAST’) seeks to limit losses by trimming equities when volatility is high. The fund has been resilient this year and simulations suggest it would have risen over the 2001-3 and 2007-9 bear markets.

Figure 1: Bear markets end when unemployment is close to peaking

Source: Refinitiv DataStream as at 27 June 2022.

–ENDS–

The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.